Money & Investing Blog

Market Euphoria: Not The Time To Review Risk Profiles And Strategic Asset Allocations

The following was published in www.seekingalpha.com by our very own John Whaley, CFA. Summary Historic market valuations accompanied by historically low volatility create a type of euphoria risk dangerous to clients. Strategic asset allocations should not be changed due to market results. Advisors and clients alike need to be aware of the dangers of a…

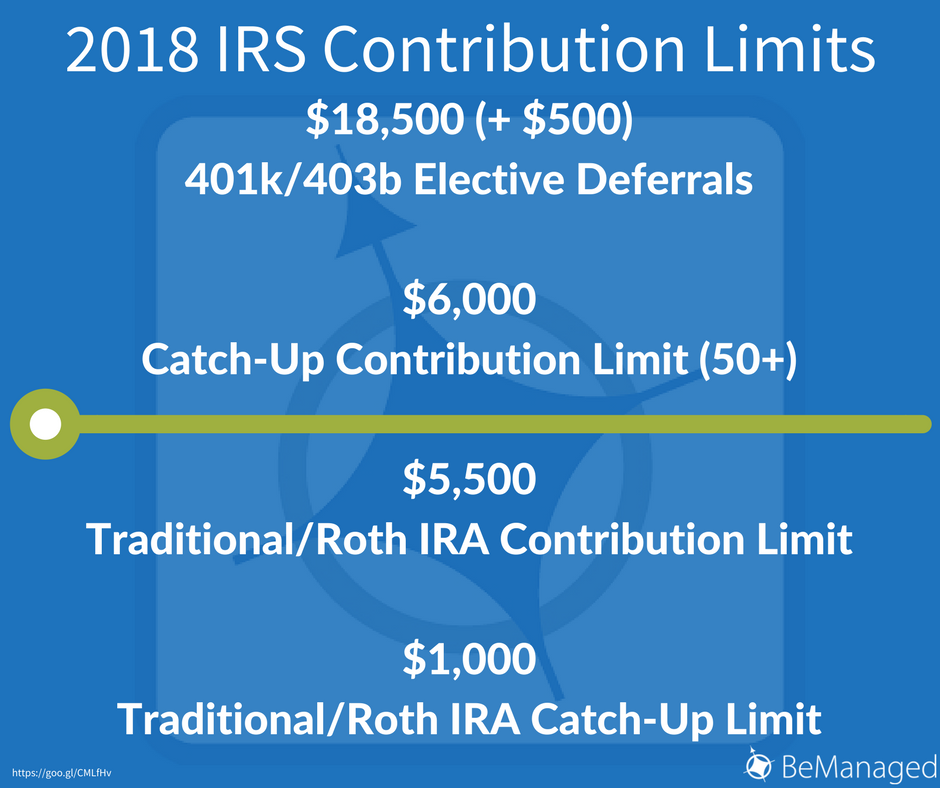

Read MoreIRS Increases 401k Contribution Limits for 2018

Today, the IRS increased 401k contribution limits to $18,500 for 2018. It is good news for individuals looking to maximize their retirement contributions. Unfortunately, IRA contribution limits remain unchanged. Recommendation: Set a reminder on your phone or calendar to review your 401k/403b contribution in mid-to-late December to ensure you are maximizing your 2018 retirement savings.…

Read MoreThe New DOL Fiduciary Rule

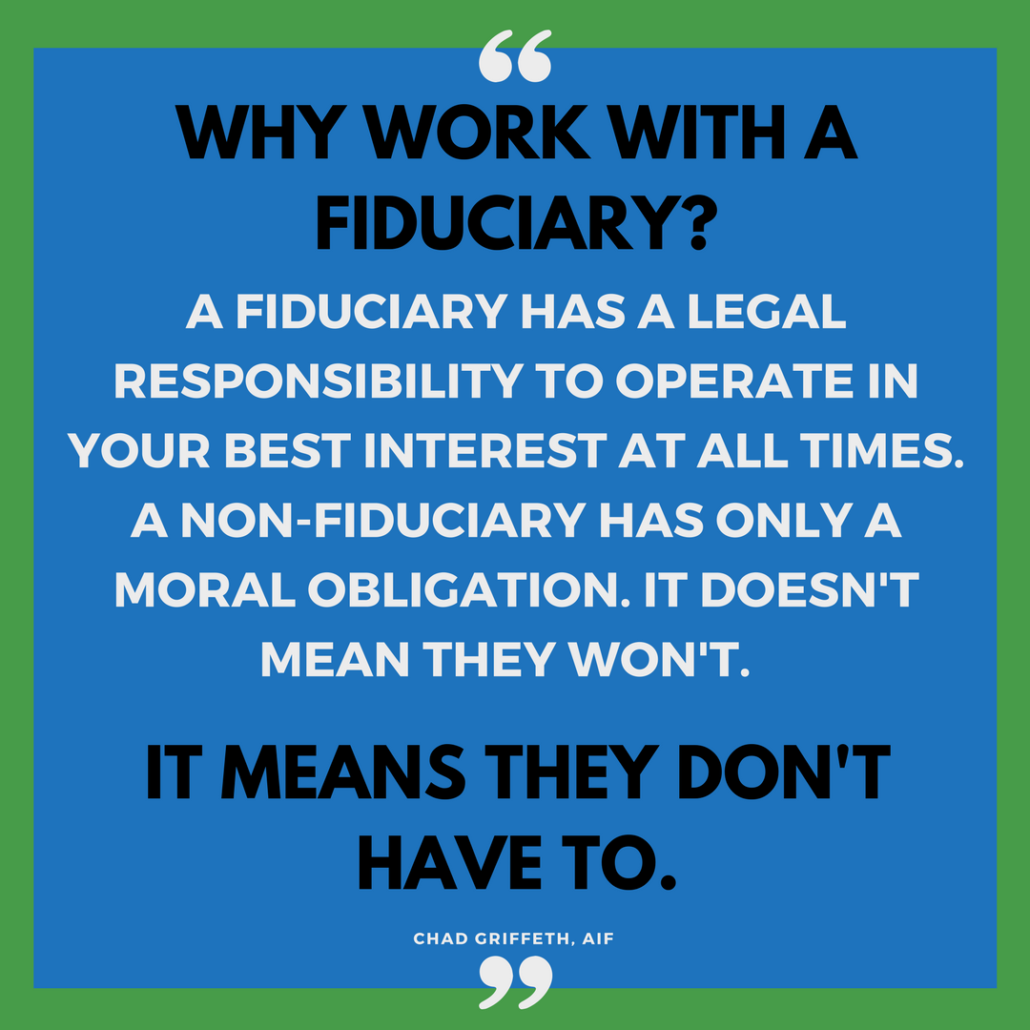

On June 9th of this month, the Department of Labor’s Fiduciary Rule went into a phased implementation period with an effective date of January 1, 2018. The rule was designed to protect investors’ retirement savings. While the rule is thousands of words long, the main focus is this: require anyone providing investment advice to individuals…

Read MoreBeManaged Recognized for 10th Year of CEFEX Certification

A few weeks ago, I was fortunate to represent BeManaged in Nashville for our tenth year of being CEFEX certified. Your next question is likely, “Ok, what is CEFEX and why does that matter?” According to the CEFEX (Centre for Fiduciary Excellence) Site: CEFEX is an independent global assessment and certification organization. It works closely with…

Read MoreHow to Review the Performance of your Investments

Your investment statements are arriving, so many of us will take a look at our investment accounts to see how we (or our advisor) did. Unfortunately, it can be a bit confusing to determine if we did well, average or poorly. Let’s look at the items that will help you determine how you did. How…

Read MoreSpecial Report – Interest Rate Spikes and the Bonds in Your Portfolio

There is rising concern regarding the impact of higher interest rates on the bond funds in client portfolio. The purpose of holding bond funds is to provide a return above the level of cash while waiting for a more rational stock market environment. As always, the potential return over and above money market funds comes…

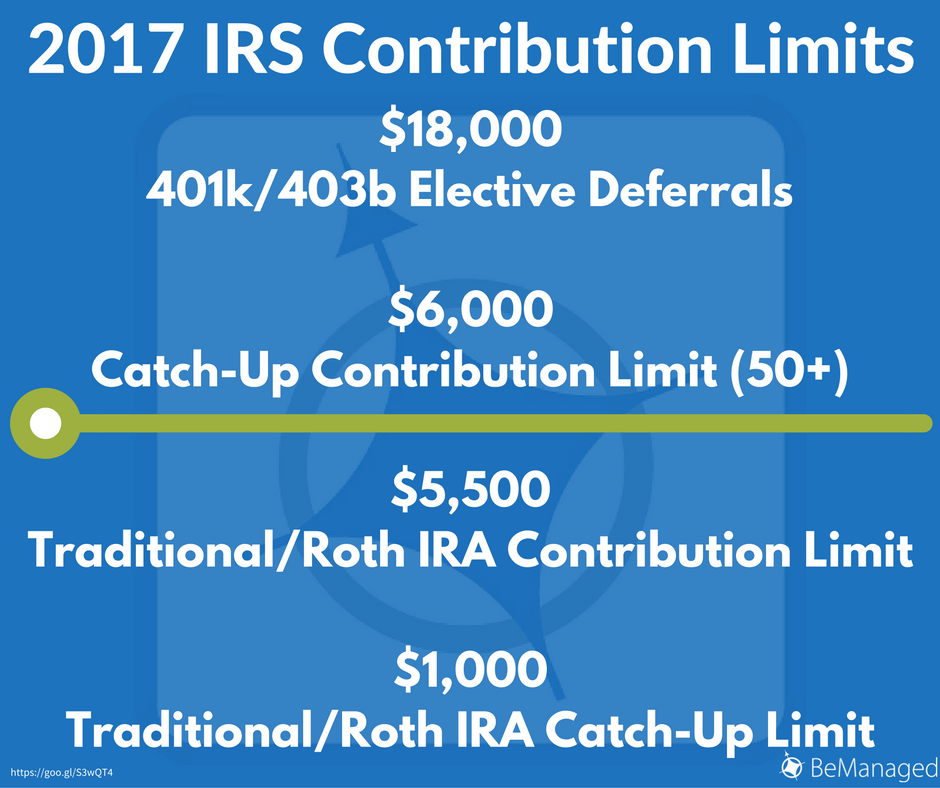

Read More2017 401k & IRA Contribution Limits Go Unchanged from 2016

2017 IRS Contribution LimitsLook familiar? That’s because it is, because the 2017 IRS 401k and IRA contribution limits were announced and there are no significant changes from 2016. Below are the limits that affect most investors. Click to Read More Details at 401khelpcenter.com

Read MoreStock and Bond Markets Remain Overvalued – October 2016

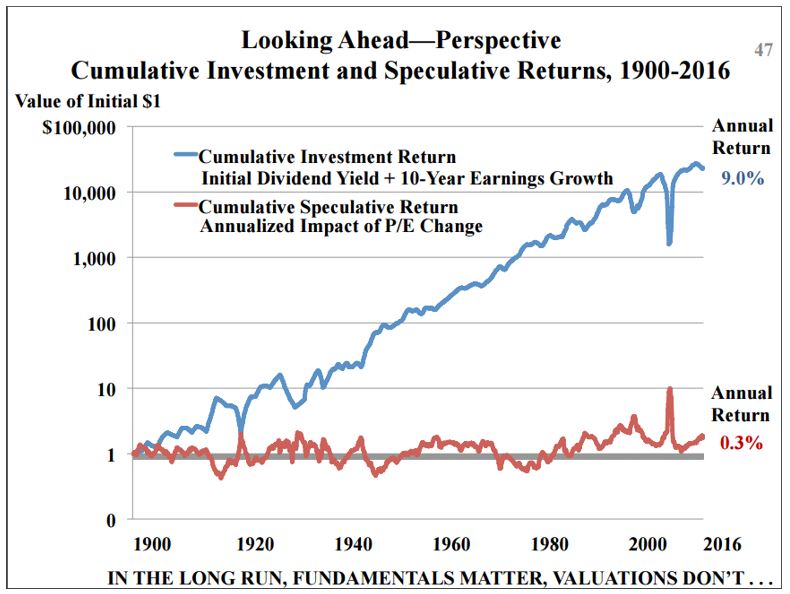

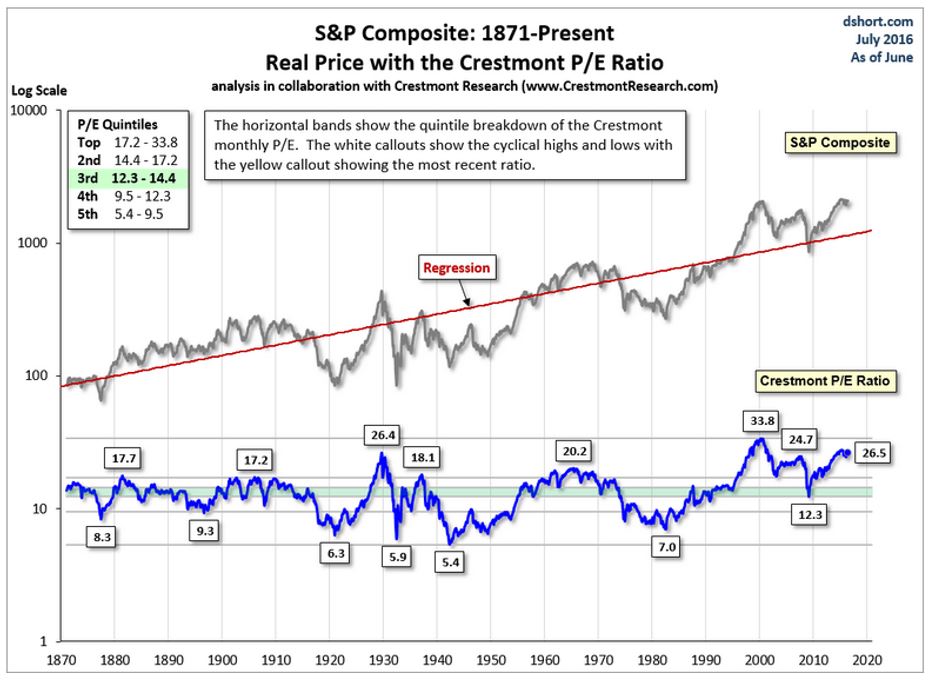

The average of four fundamental valuation measures shows a market nearly two standard deviations (82%) above its historical norm: Source: Advisor Perspectives, October 6, 2016 https://www.advisorperspectives.com/dshort/updates/2016/10/04/market-remains-overvalued Remember, asset price inflation (speculative return) contributes a very small amount towards total return over the long haul. Since 2012, however, speculative returns have been in the double digits…

Read MoreReduced Future Returns Expected for Retirement Savings

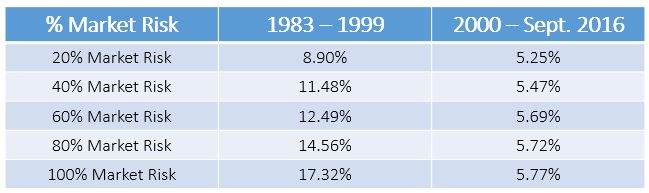

Investment advisors and financial salespeople need to help retirement savers understand that we have entered a new era for investment returns, an era of much lower earnings growth for companies and significantly lower interest rates for stock and bond investments. Let’s look at historic investment returns for portfolios with differing levels of market risk: John…

Read MoreWhat is “The Right Price” to Pay for a Stock?

The amount of money we decide to place in common stocks in your investment portfolio is partially driven by the prices we have to pay for those stocks. The higher the price we pay for a dollar’s worth of earnings generated by a stock, the lower the chance that we receive the returns we need…

Read More