Everyone Makes Investing Mistakes, Just Don’t Create ‘Anchors’

Our friend Carl Richards, writing for the NYTimes.com Bucks blog, does an excellent job of speaking to the ‘waiting-until-I-get-back-to-even’ mistake many investors make. It’s called anchoring. Essentially, we create a value in our mind for an investment we want to receive before selling. The following are some excellent examples of how this can hurt you more than simply cutting your losses:

Our friend Carl Richards, writing for the NYTimes.com Bucks blog, does an excellent job of speaking to the ‘waiting-until-I-get-back-to-even’ mistake many investors make. It’s called anchoring. Essentially, we create a value in our mind for an investment we want to receive before selling. The following are some excellent examples of how this can hurt you more than simply cutting your losses:

One of the more common behavioral mistakes we make when it comes to investment decisions is the tendency to anchor to a certain value or price. When we focus on, or anchor to, a price, it can lead to costly blunders. Here are a few examples:

1. You pay $800,000 for your home, and a few years later you need to sell it. We have a tendency to feel like we should at least be able to get what we paid for it. So you insist upon listing it for $800,000, even though the market value is less than that. You pass on offers around $775,000 and then ride the market all the way down to the point where you are just hoping to get $650,000 a year later. Now that first offer looks like a dream.

The reality is the market doesn’t care what you paid for you house. It doesn’t care how much you put in to it or what it cost you to landscape. All that matters is what it is worth today.

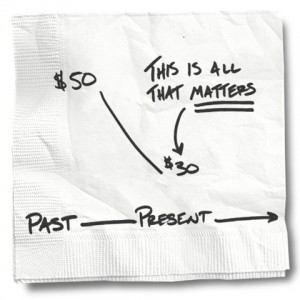

2. You buy a stock for $50 a share, and six months later it is $30. You decide that you really shouldn’t own it anymore but you want to wait until you “get back to even” before you sell. This idea of holding on to an investment that is no longer appropriate, or may have been a mistake in the first place, until you get back to even makes no sense. The fact that you paid $50 has no bearing whatsoever on what you should do now.

In fact, I think it is fair to say that getting back to even is never a good reason to hold on to an investment. If you find yourself saying that, it’s time to re-evaluate.

3. Your portfolio was worth $500,000 at the top of the tech bubble in early 2000, and you still think about that value each time you open your statement and see that it’s worth less than that. You just want to get back to your high-water mark of $500,000.

This may not have any impact on your decisions, but it sure is affecting your life. I know people like this, still holding on to a value in the past. It is like that guy next door who is still telling stories of his glory days in high school football.

The past is the past. All that matters now is making the correct decision for today.